UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| [X] | Definitive Proxy Statement | |

| [ ] | Definitive Additional Materials | |

| [ ] | Soliciting Material Pursuant Under Rule 14a-12 |

RCI Hospitality Holdings, Inc.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

| [ ] Fee paid previously with preliminary materials. |

| [ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

RCI HOSPITALITY HOLDINGS, INC.

10737 CUTTEN ROAD

HOUSTON, TEXAS 77066

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, SEPTEMBER 19, 201714, 2021

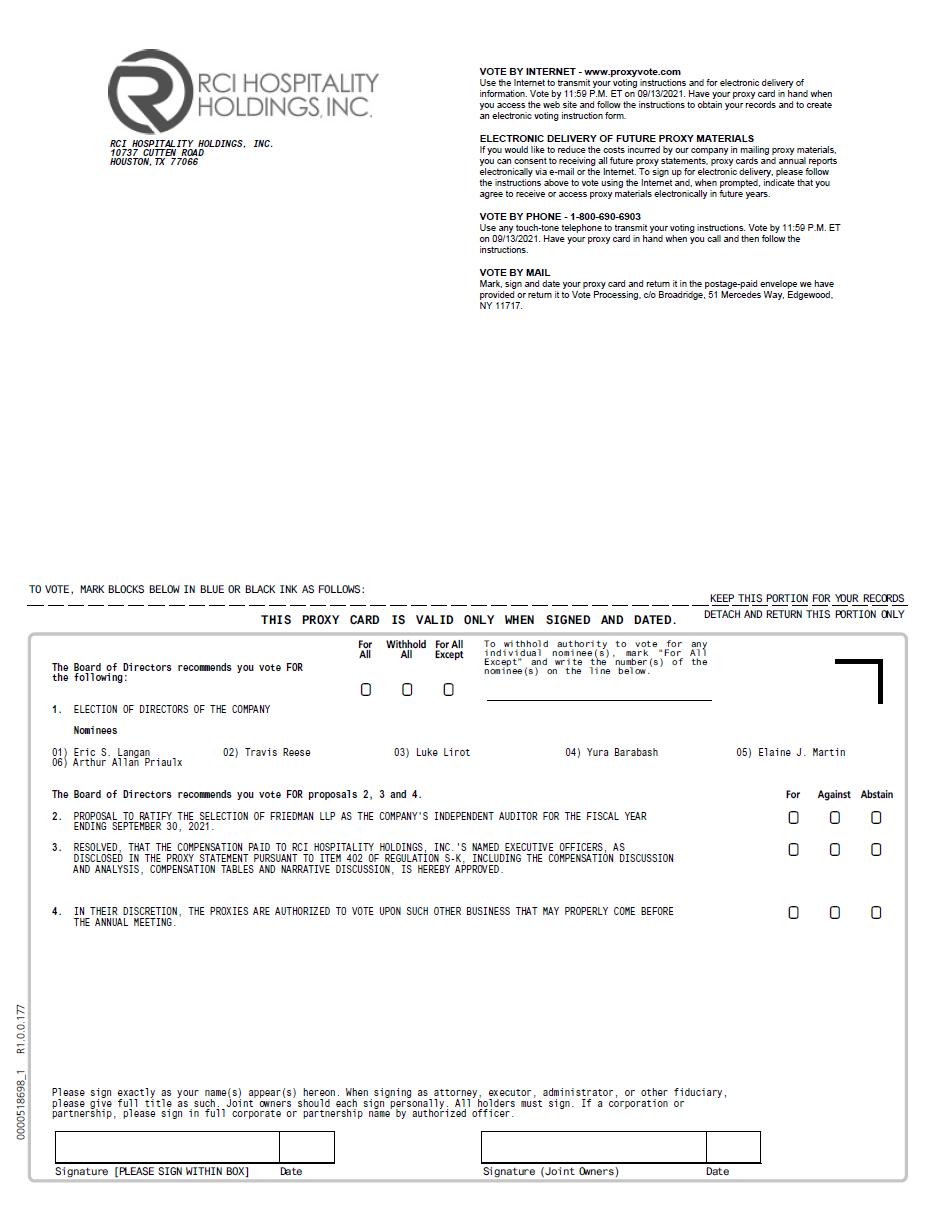

The Annual Meeting of Stockholders (the “Annual Meeting”) of RCI Hospitality Holdings, Inc. (“we,” “us” and the “Company”) will be held at our corporate offices located at 10737 Cutten Road, Houston, Texas 77066, on Tuesday, September 19, 201714, 2021 at 10:00 a.m. (Central Time) for the following purposes:

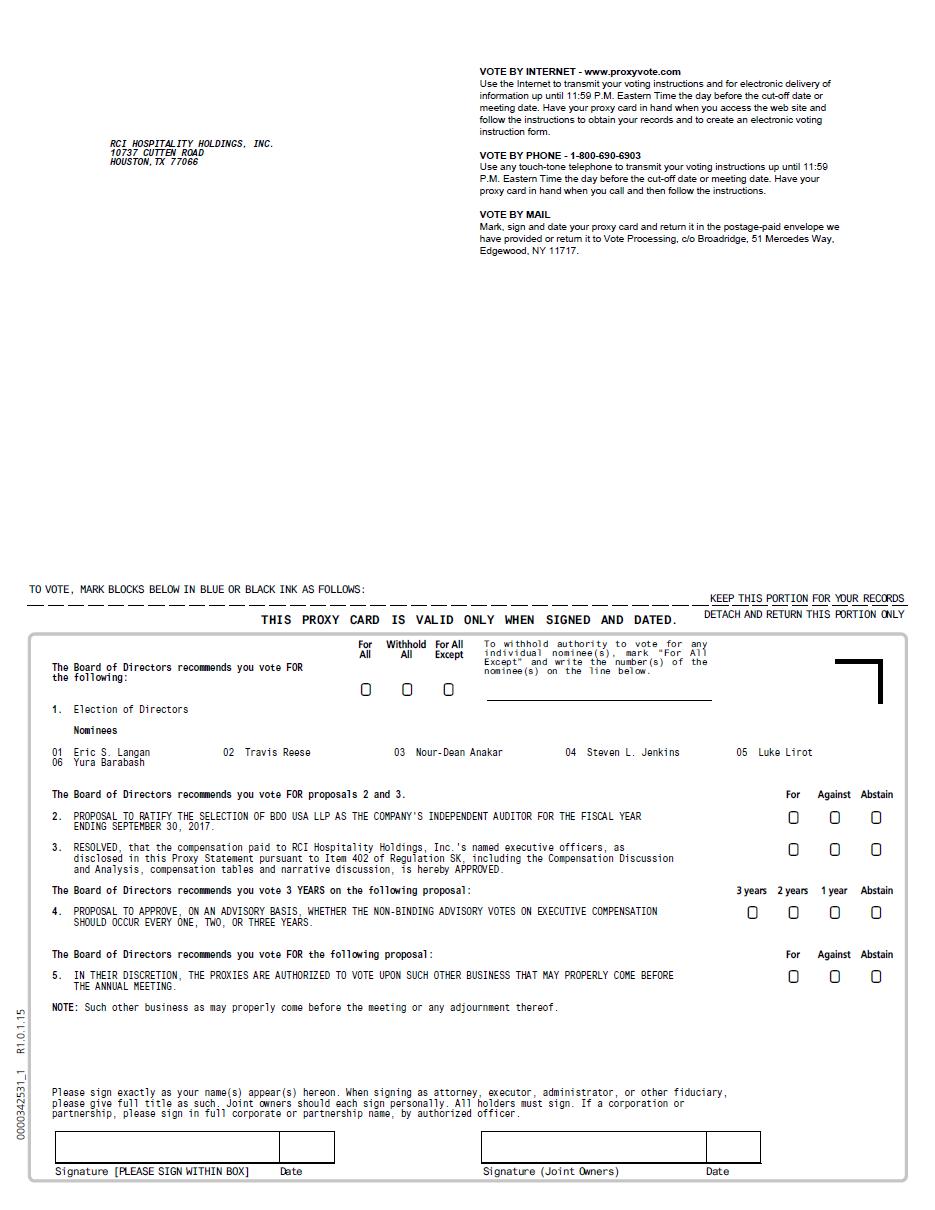

| (1) | To elect six directors; | |

| (2) | To ratify the selection of | |

| (3) | To approve a non-binding advisory resolution on executive compensation; and | |

| (4) | ||

| To act upon such other business as may properly come before the Annual Meeting. |

Only holders of common stock of record at the close of business on July 24, 2017,26, 2021, will be entitled to vote at the Annual Meeting or any adjournment thereof. You are cordially invited to attend the Annual Meeting.

We have elected to furnish proxy materials and our fiscal 20162020 Annual Report on Form 10-K (“Annual Report”) to many of our stockholders over the Internet pursuant to Securities and Exchange Commission rules, which should allow us to reduce costs. On or about August 9, 2017,2, 2021, we began mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and Annual Report and how to vote online. All stockholders who have previously expressed a specific request to receive paper copies of proxy materials will be sent a copy of the Proxy Statement and Annual Report by mail beginning on or about August 16, 2017.2, 2021. The Notice also contains instructions on how you can elect to receive a printed copy of the Proxy Statement and Annual Report, if you only received a Notice by mail.The Proxy Statement, Annual Report to security holders for the year ended September 30, 2016,2020 and proxy card and President’s letter are available at www.proxyvote.com.

Due to the public health impact of the novel coronavirus disease (“COVID-19”) outbreak, any person in attendance who exhibits cold or flu-like symptoms or who has been exposed to COVID-19 may be asked to leave the premises for the protection of the other attendees. We reserve the right to take any additional precautionary measures deemed appropriate in relation to the meeting and access to the meeting premises. As a result of the public health and travel risks and concerns due to COVID-19, we may announce alternative arrangements for the meeting, which may include switching to a virtual meeting format, or changing the time, date or location of the Annual Meeting. If we take this step, we will announce any changes in advance in a press release available on our website (rcihospitality.com) and filed with the Securities Exchange Commission as additional proxy materials, and as otherwise required by applicable state law.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. If you received the proxy materials by mail, you can vote your shares by completing, signing, dating, and returning your completed proxy card, by telephone or over the Internet. If you received the proxy materials over the Internet, a proxy card was not sent to you, and you may vote your shares only by telephone or over the Internet. To vote by telephone or Internet, follow the instructions included in the proxy statement.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| |

| ERIC S. LANGAN | |

| CHAIRMAN OF THE BOARD AND PRESIDENT |

AUGUST 9, 2017August 2, 2021

HOUSTON, TEXAS

RCI HOSPITALITY HOLDINGS, INC.

10737 CUTTEN ROAD

HOUSTON, TEXAS 77066

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 19, 201714, 2021

This proxy statement (the “Proxy Statement”) is being furnished to stockholders in connection with the solicitation of proxies by the Board of Directors of RCI Hospitality Holdings, Inc., a Texas corporation (“we,” “us” and the “Company”), for their use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at our corporate offices located at 10737 Cutten Road, Houston, Texas 77066, on Tuesday, September 19, 201714, 2021 at 10:00 a.m. (Central Time), and at any adjournments thereof, for the purpose of considering and voting upon the matters set forth in the accompanying Notice of Annual Meeting of Stockholders.

We have elected to furnish proxy materials and our fiscal 20162020 Annual Report on Form 10-K (“Annual Report”) to many of our stockholders over the Internet pursuant to Securities and Exchange Commission (“SEC”) rules, which should allow us to reduce costs. On or about August 9, 2017,2, 2021, we began mailing to most of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our Proxy Statement and Annual Report and how to vote online. All stockholders who have previously expressed a specific request to receive paper copies of proxy materials will be sent a copy of the Proxy Statement and Annual Report by mail beginning on or about August 16, 2017.2, 2021. The Notice also contains instructions on how you can elect to receive a printed copy of the Proxy Statement and Annual Report, if you only received a Notice by mail.The Proxy Statement, Annual Report to security holders for the year ended September 30, 2016,2020 and proxy card and President’s letter are available at www.proxyvote.com.The cost of solicitation of proxies is being borne by us.

The close of business on July 24, 201726, 2021 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. As of July 24, 2017,26, 2021, we had 9,718,7118,999,910 shares of common stock, par value $0.01 per share, issued and outstanding. The presence, in person or by proxy, of a majority of the outstanding shares of common stock on the record date is necessary to constitute a quorum at the Annual Meeting. Each share is entitled to one vote on all issues requiring a stockholder vote at the Annual Meeting. A plurality of the shares voted in person or represented by proxy at the Annual Meeting will elect as Directorsdirectors the nominees named in Proposal Number 1. Stockholders may not cumulate their votes for the election of Directors.directors. The affirmative vote of a majority of the shares of common stock present or represented by proxy and entitled to vote at the Annual Meeting is required for the ratification of the appointment of BDO USA,Friedman LLP as our independent registered public accounting firm (see Proposal Number 2). The affirmative vote of a majority of the total votes present in person or by proxy is required to approve the non-binding advisory resolution on executive compensation (see Proposal Number 3). A plurality of the votes present in person or by proxy will determine the stockholders selection on the frequency of advisory resolutions on executive compensation (see Proposal Number 4). Abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum. Abstentions and broker non-votes will not be counted as having voted either for or against a proposal.

All shares represented by properly executed proxies, unless such proxies previously have been revoked, will be voted at the Annual Meeting in accordance with the directions on the proxies. If no direction is indicated, the shares will be voted(i)FORTHE ELECTION OF THE NOMINEES NAMED HEREIN, (ii)FOR THE RATIFICATION OF BDO USA,FRIEDMAN LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2017,2021, and (iii) FOR APPROVAL OF THE NON-BINDING ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION and (iv) FOR HOLDING THE ADVISORY VOTES ON EXECUTIVE COMPENSATION EVERY THREE YEARS.The Board of Directors is not aware of any other matters to be presented for action at the Annual Meeting. If any other matter is properly presented at the Annual Meeting, however, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment on such matters.

Under the rules of the New York Stock Exchange (“NYSE”), brokers who hold shares in “street name” for customers are precluded from exercising voting discretion with respect to the approval of non-routine matters (so called “broker non-votes”) where the beneficial owner has not given voting instructions. Because most large brokerage firms are NYSE member organizations, these rules affect almost all public companies and not just those listed on the NYSE. Effective July 1, 2009, the NYSE amended its rule regarding discretionary voting by brokers on uncontested elections of directors such that any investor who does not instruct the investor’s broker on how to vote in an election of directors will cause the broker to be unable to vote that investor’s shares on an election of directors. Previously, the broker could exercise its own discretion in determining how to vote the investor’s shares even when the investor did not instruct the broker on how to vote. Accordingly, withWith respect to the election of directors (see Proposal Number 1), a broker is not entitled to vote the shares of common stock unless the beneficial owner has given instructions. Additionally, a broker is not entitled to vote uninstructed shares on matters relating to executive compensation, including the vote to approve a non-binding resolution on executive compensation (see Proposal Number 3) and the vote on how often the advisory votes on executive compensation should occur (see Proposal Number 4). With respect to the ratification of the appointment of BDO USA,Friedman LLP as our independent registered public accounting firm (see Proposal Number 2), a broker will have discretionary authority to vote the shares of our stock if the beneficial owner has not given instructions.

The enclosed Proxy, even though executed and returned, may be revoked at any time prior to the voting of the Proxy (i) by execution and submission of a revised proxy, (ii) by written notice to our Secretary, or (iii) by voting in person at the Annual Meeting.

| Page 1 |

PROPOSAL 1

TO ELECT SIX DIRECTORS FOR THE ENSUING YEAR

NOMINEES FOR DIRECTORS

The persons named in the enclosed Proxy have been selected by the Board of Directors to serve as proxies (the “Proxies”) and will vote the shares represented by valid proxies at the Annual Meeting of Stockholders and adjournments thereof. Unless otherwise instructed or unless authority to vote is withheld, the enclosed Proxy will be voted for the election of the nominees listed below. Each duly elected Directordirector will hold office until his successor shall have been elected and qualified. Although the Board of Directors does not contemplate that any of the nominees will be unable to serve, if such a situation arises prior to the Annual Meeting, the persons named in the enclosed Proxy will vote for the election of such other person(s) as may be nominated by the Board of Directors.

The Board of Directors unanimously recommends a voteFOR the election of each of the nominees listed below.

All of the nominees presently serve as Directors, except for Yura Barabash. Mr. Barabash was nominated to fill the Board seat that will be vacated by Robert L. Watters, whodirectors. Nourdean Anakar informed us on July 5, 201713, 2021 that he will retire from the Board of Directors effective as of the date of the 20172021 Annual Meeting of Stockholders. His vacated seat on the Board will not presently be filled, and accordingly the Board is being reduced from seven to six seats.

Eric S. Langan, age 49,53, has been a Directordirector since 1998, and our President, CEO and Chairman since March 1999. He began his career in the hospitality industry in 1989 and has developed significant expertise in sports bar/restaurants and adult entertainment nightclubs, including related areas of real estate development and finance. Mr. Langan built the XTC Cabaret nightclub brand and merged it into RCI in 1998, expanding the scope of the company. He has been involvedinstrumental in bringing professional marketing, management, finance, and technology practices and systems to the adult entertainment business since 1989. From January 1997 throughgentlemen’s club industry. As one of the present, he has heldoriginal founders of the positionNational Association of President of XTC Cabaret, Inc. Since 1989,Club Executives (ACE), Mr. Langan has exercised managerial control over more than a dozen adult entertainment businesses.been an active member of its Board of Directors since 1999. Through these activities, Mr. Langan has acquired the knowledge and skills necessary to successfully operate adult entertainment businesses.

Involvement in certain legal proceedings: On September 21, 2020, as part of the settlement of a civil administrative proceeding with the SEC, the Company, Mr. Langan and Phil Marshall (our former chief financial officer) agreed, without admitting or denying the findings, to a cease-and-desist order regarding certain sections of the Securities Exchange Act of 1934 and certain rules promulgated thereunder.

The SEC’s order as to the Company, Eric Langan, and Phil Marshall found that, from fiscal 2014 through 2019, the Company failed to disclose a total of $615,000 in executive compensation in the form of perquisites. According to the order, these undisclosed perquisites included the cost of the personal use of the Company’s aircraft and Company-provided vehicles, reimbursements for personal airline flights, charitable corporate contributions to the school two of Mr. Langan’s children attended, and housing costs and meal allowance for Mr. Marshall. In addition, the order found that the Company failed to disclose related party transactions involving Mr. Langan’s father and brother and a director’s brother. The order further found that the Company failed to keep books and records that allowed it to report, and lacked sufficient internal controls concerning, these executive perquisites and related party transactions.

The SEC’s order as to the Company, Mr. Langan, and Mr. Marshall found that the Company and Mr. Langan violated, and Mr. Langan and Mr. Marshall caused the Company to violate, the proxy solicitation provisions of Section 14(a) of the Securities Exchange Act of 1934 and Rules 14a-3 and 14a-9 thereunder. The order further found that the Company violated, and Mr. Langan and Mr. Marshall caused the Company to violate, the reporting provisions of Section 13(a) of the Exchange Act and Rules 13a-1 and 12b-20 thereunder, the books and records provisions of Sections 13(b)(2)(A) and 13(b)(2)(B) of the Exchange Act, and the disclosure controls provision of Rule 13a-15(a) under the Exchange Act. The Company, Mr. Langan, and Mr. Marshall agreed, without admitting or denying the SEC’s findings, to a cease-and-desist order and to pay civil penalties in the amounts of $400,000, $200,000, and $35,000, respectively.

Travis Reese, age 47,51, became a director and our Director and V.P.-Director of TechnologyExecutive Vice President in 1999. From 1997 through 1999, Mr. Reese had been a senior network administrator at St. Vincent’s Hospital in Santa Fe, New Mexico. During 1997, Mr. Reese was a computer systems engineer with Deloitte & Touche. From 1995 until 1997, Mr. Reese was Vice President with Digital Publishing Resources, Inc., an Internet service provider. From 1994 until 1995, Mr. Reese was a pilot with Continental Airlines. From 1992 until 1994, Mr. Reese was a pilot with Hang On, Inc., an airline company. Mr. Reese has an Associate’s Degree in Aeronautical Science from Texas State Technical College. In addition to beingMr. Reese has been involved in the adult entertainment industry since 1992, Mr. Reese’s in-depth information technology1992. His experience and knowledge in this industry is essential to the Board’s oversight of our internet businesses.

Steven L. Jenkins, age 60, has been a Director since June 2001. Since 1988, Mr. Jenkins has been a certified public accountant with Pringle Jenkins & Associates, P.C., located in Houston, Texas. Mr. Jenkins is the President and owner of Pringle Jenkins & Associates, P.C. Mr. Jenkins has a BBA Degree (1979) from Texas A&M University. Mr. Jenkins is a member of the AICPA and the TSCPA. Mr. Jenkins’ impressive accounting background makes him a valuable asset to the Board and the Audit Committee.

Luke Lirot, age 61,65, became a Director indirector on July 31, 2007. Mr. Lirot received his law degree from the University of San Francisco in 1986. After serving as an intern in the San Francisco Public Defender’s Office in 1986, Mr. Lirot returned to Florida and established a private law practice where he continues to practice and specializes in adult entertainment issues. He is a past President of the First Amendment Lawyers’ Association and has actively participated in numerous state and federal legal matters. Mr. Lirot represents as counsel scores of individuals and entities within our industry. Having practiced in this area for over 30 years, he is aware of virtually every type of legal issue that can arise, making him an important member of the Board.

Nour-Dean Anakar, age 60, became a Director in September 2010. Mr. Anakar has over 20 years of experience in senior positions in the development and management of betting and gaming, sports and entertainment, and hospitality and leisure operations in the United States, Europe, and Latin America. From 1988 until 2000 he held executive management and business development positions with Ladbrokes USA and Ladbrokes South America. In 2001, Mr. Anakar became the managing partner of LCIN LLC and LCIN S.A., San Diego and Buenos Aires based gaming companies, which were contracted by Grupo Codere of Spain to oversee the development of all new technology gaming projects and operations in Latin America. He received his BA in Management Science from Duke University and CHA in Hospitality Management from the Conrad Hilton College at the University of Houston. Mr. Anakar’s experience managing and developing businesses in industries with similar characteristics to ours make him an excellent fit to the Board.

Yura Barabash, age 42, is46, became a nominee for election to the Board of Directors. Since August 2016,director on September 19, 2017. Mr. Barabash has extensive corporate finance experience across multiple industries domestically and internationally, and has been involved in multiple equity and debt financings and M&A transactions for public and private companies in the US, China, Brazil, EU and Russia. Since July 2020 to February 2021 Mr. Barabash was a Chief Operating Officer of Gingko Online Learning LLC, private online learning company in Florida and a consultant to Chengdu Gingko Education Management, educational management company in Chengdu, China since August 2019. From 2016 to June 2019 he was a Senior Vice President of Finance at Motorsport Network LLC (motorsportnetwork.com)(www.motorsportnetwork.com) in Miami, Florida, the largest motorsport and auto-relateddata enabled digital media company in the world. He is also presently Portfolio ManagerPrior to joining Motorsport Network, he was an investment banker at Enerfund, LLC, a small Miami-based private equity fund, a position he has held since June 2013.Primary Capital from 2011 until 2016. Previously, Mr. Barabash was the Managing Director of Investment Bankingan investment banker at Primary Capital LLC in New York City from February 2011 to June 2016.Rodman & Renshaw and Merrill Lynch. He holds a B.A. from Sevastopol City University in Ukraine and a Master in International Affairs from Columbia University. HeUniversity in New York City, and is fluent in Russian. Mr. Barabash will beis a valuable addition tomember of the Board of Directors based on his extensive corporate finance and investment banking experience across multiple industries domestically and internationally with a wide range of transactions (debt and equity). He also possesses extensive financial modeling and investor relationship experience and experience in diligence, governance and accounting.

| Page 2 |

Elaine J. Martin, age 64, became a director on August 8, 2019. She is co-founder and general partner of two privately-held Houston area businesses for which she provides a broad array of management and accounting functions on a day-to-day basis. In 1993, she co-founded Medco Manufacturing LLC, which develops, manufactures and sells, under Food and Drug Administration (FDA) guidelines, equipment and disposable products used by plastic surgeons in domestic and international markets. In 1989, Ms. Martin co-founded Aero Tech Aviation LLC, which trains foreign nationals for the Federal Aviation Administration (FAA) Air Frame and Power Plant examination, for their license to repair US-origin aircraft. Earlier in her career, she was a Registered Nurse specializing in cosmetic surgery. Ms. Martin received her BS in Biology and Chemistry from Houston Baptist University. Her volunteer activities have included serving as a member of the Board of Directors of Texas A&M University Mothers’ Club (Aggie Moms). Ms. Martin’s business acumen and experience running companies make her an important member of the Board.

Arthur Allan Priaulx, age 81, became a director on August 8, 2019. He has more than 45 years of experience in the communications industry. Earlier in his career, he was Vice President and General Manager of King Features Division of Hearst Corporation, in charge of worldwide newspaper activities and product licensing. He was also publisher of American Banker, a leading trade publication in the financial services industry, when it was owned by Thomson Financial. In 1993, he founded Resource Media Group, a New York-based financial media and investor relations firm. His clients included a wide range of companies, including RCI Hospitality Holdings, Inc., for which he provided public and investor relations services from 1994 to 2013. Mr. Priaulx has been retired since 2014. He attended Dartmouth College and University of Southampton in the U.K. He has also completed graduate-level courses at INSEAD Business School in France and the Wharton School of the University of Pennsylvania. His volunteer activities have included serving as national vice president of United Cerebral Palsy.

OUR DIRECTORS AND EXECUTIVE OFFICERS

Our directors are elected annually and hold office until the next annual meeting of our stockholders or until their successors are elected and qualified. Officers are elected annually and serve at the discretion of the Board of Directors. There is no family relationship between or among any of our directors and executive officers. Our Board of Directors presently consists of seven persons but will be reduced to six persons.persons as of the date of this Annual Meeting. The following table sets forth our directors and executive officers:

| Name | Age | Position | ||

| Eric S. Langan | Director (Chairman) and CEO/President | |||

| Chief Financial Officer | ||||

| Travis Reese | Director and | |||

| Luke Lirot | Director | |||

| Director | ||||

| Yura Barabash | 46 | Director | ||

| Elaine J. Martin | 64 | Director | ||

| Arthur Allan Priaulx | 81 | Director |

Phillip Marshall hasBradley Chhay, age 37, was appointed as our CFO on September 14, 2020. He is a Certified Public Accountant (CPA), Certified Fraud Examiner (CFE), and Certified Information Systems Auditor (CISA). He joined us in November 2015 as Controller in charge of migrating the company to an upgraded ERP system and enhancing internal and external audit and SEC reporting functions. From 2007 through 2009, he was an auditor for Deloitte & Touche LLP. From 2009 through 2013, he served as our Chief Financial Officer since May 2007. HeInternal Audit Senior, IT Auditor, and Senior Fraud Auditor for Live Nation Entertainment, Inc. of Beverly Hills, a publicly-traded company that markets tickets for live entertainment worldwide, owns and operates entertainment venues, and manages music artists. From 2013 through 2015, Mr. Chhay was previously controlleran Audit Supervisor and Global ERP Project Lead for RigNet, Inc. of Dorado Exploration, Inc., anHouston, a publicly-traded digital technology company serving the oil and gas, explorationmaritime and production company, from February 2007 to May 2007. He previouslygovernment markets. After RigNet, he briefly served as Chief Financial Officer of CDT Systems, Inc.,CFO for a publicly held water technology company, from July 2003 to September 2006. In 1972, Mr. Marshall began his public accounting career with the international accounting firm, KMG Main Hurdman. After its merger with Peat Marwick, Mr. Marshall served as an audit partner at KPMG for several years. After leaving KPMG, Mr. Marshall was partner in charge of the audit practice at Jackson & Rhodes in Dallas from 1992 to 2003, where he specialized in small publicly held companies. Mr. Marshall is also a trustee of United Mortgage Trust, United Development Funding IV and United Development Funding V, publicly held real estate investment trusts.smaller, privately-held, multi-unit restaurant chain.

RELATED TRANSACTIONS

Our Board of Directors has adopted a policy that our business affairs will be conducted in all respects by standards applicable to publicly held corporations and that we will not enter into any transactions and/or loans between us and our officers, directors and 5% shareholders unless the terms are no less favorable than could be obtained from independent, third parties and will be approved by a majority of our independent and disinterested directors. We currently have four independent directors, Steven Jenkins, Nour-Dean Anakar, Robert Watters and Luke Lirot.

Presently, our Chairman and President, Eric Langan, personally guarantees all of the commercial bank indebtedness of the company. Mr. Langan receives no compensation or other direct financial benefit for any of the guarantees. Except for these guarantees,

In November 2018, we knowborrowed $500,000 from Ed Anakar and $100,000 from Allen Chhay as part of no related transactions that have occurred sincea larger group of private lenders. The note bears interest at the beginningrate of 12% per annum and matures in November 2021. The note is payable in monthly installments of interest only with a balloon payment of all unpaid principal and interest due at maturity. Ed Anakar is the brother of Nourdean Anakar, a director of the Company. We paid Ed Anakar, our director of operations – club division, employment compensation of $502,404, $550,000, and $488,462 during the fiscal yearyears ended September 30, 20162020, 2019, and 2018, respectively. Allen Chhay is the brother of Bradley Chhay, our CFO, and is not employed by the Company or any currently proposed transactions.of its subsidiaries.

| Page 3 |

We used the services of Nottingham Creations, and previously Sherwood Forest Creations, LLC, both furniture fabrication companies that manufacture tables, chairs and other furnishings for our Bombshells locations, as well as providing ongoing maintenance. Nottingham Creations is owned by a brother of Eric Langan (as was Sherwood Forest). Amounts billed to us for goods and services provided by Nottingham Creations and Sherwood Forest were approximately $59,000 in fiscal 2020, $134,000 in fiscal 2019, and $321,000 in fiscal 2018. As of September 30, 2020 and 2019, we owed Nottingham Creations and Sherwood Forest $0 and $6,588, respectively, in unpaid billings. Nottingham Creations continues to provide services to the company, and billed us approximately $118,000 during the 2021 fiscal year through June 30, 2021.

TW Mechanical LLC (“TW Mechanical”) provided plumbing and HVAC services to both a third-party general contractor providing construction services to the Company, as well as directly to the Company during fiscal 2020 and 2019. A son-in-law of Eric Langan owns a noncontrolling interest in TW Mechanical. Amounts billed by TW Mechanical to the third-party general contractor were approximately $19,000, $452,000, and $120,000 for the fiscal years 2020, 2019, and 2018, respectively. Amounts billed directly to the Company were approximately $62,000, $47,000, and $7,000 for the fiscal years 2020, 2019, and 2018, respectively. As of September 30, 2020 and 2019, the Company owed TW Mechanical approximately $5,700 and $0, respectively, in unpaid direct billings. Amounts billed by TW Mechanical directly to us totaled approximately $388,000 during the 2021 fiscal year through June 30, 2021. There were no billings to the third-party contractor during the same period.

Review, Approval, or Ratification of Related Transactions

Currently, we rely on ourOn September 23, 2019, the Board of Directors, to reviewacting upon the recommendation of its Audit Committee, adopted a written related party transaction policy, under which related party transactions are subject to review, approval, rejection, modification and/or ratification by the Audit Committee. The policy provides that prior to the entry into any transaction between the Company and one of its officers, directors, 5% shareholders or an immediate family member of any of the foregoing (a “related party”), such transaction will be reported to the Company’s chief compliance officer. The Company’s chief compliance officer will undertake an evaluation of the transaction. If that evaluation indicates that the transaction would require the Audit Committee’s approval, the Company’s chief compliance officer will report this transaction to the Audit Committee. The Audit Committee will review the material facts of all related party transactions that require the Audit Committee’s approval and either approve or disapprove of the entry into the related party transaction. If advance Audit Committee approval of a related party transaction is not feasible, then the related party transaction will be considered and, if the Audit Committee determines it to be appropriate, ratified at the Audit Committee’s next regularly scheduled meeting. In determining whether to approve or ratify a related party transaction, the Audit Committee will take into account factors it deems appropriate. In the event that the Audit Committee determines not to ratify and approve the related party transaction, then the Audit Committee will instruct that the related party transaction be rescinded or unwound. The Audit Committee will not approve or ratify any related party transaction unless it deems that the transaction is on terms no less favorable than terms generally available to an ongoing basisunaffiliated third-party under the same or similar circumstances and the extent of the related party’s interest in the transaction. No director will participate in any discussion or approval of a related party transaction for which he or she is a related party, except that the director shall provide all material information concerning the transaction to prevent conflictsthe Audit Committee.

In reviewing related party transactions under the policy, the Audit Committee will review and consider one or more of interest. Our Boardthe following as it seems appropriate for the circumstances: (1) the related party’s interest in the related party transaction; (2) the approximate dollar value of Directors reviews athe amount involved in the related party transaction; (3) the approximate dollar value of the amount of the related party’s interest in the transaction without regard to the amount of any profit or loss; (4) whether the transaction was undertaken in the ordinary course of business of the Company; (5) whether the transaction with the related party is proposed to be, or was, entered into on terms no less favorable to the Company than terms that could have been reached with an unrelated third party; (6) the purpose of, and the potential benefits to the Company of, the related party transaction; (7) whether the related party transaction would impair the independence of an outside director; (8) required public disclosure, if any; and (9) any other information regarding the related party transaction or the related party in the context of the proposed transaction that would be material to investors in light of the affiliationscircumstances of the director, officer, or employee andparticular transaction. The Audit Committee will review all relevant information available to it about the affiliations of such person’s immediate family. Our Board of Directors willrelated party transaction. The Audit Committee may approve or ratify athe related party transaction only if itthe Audit Committee determines in good faith that, under all of the circumstances, the transaction is consistentfair as to the Company. The Audit Committee, in its sole discretion, may impose such condition as it deems appropriate on the Company or the related party in connection with our best interestsapproval of the related party transaction.

Our Audit Committee is composed of all independent directors, including Yura Barabash, Elaine Martin and Arthur Allan Priaulx. We additionally have two other independent directors, Nourdean Anakar and Luke Lirot, who are not on the best interestsAudit Committee. The definition of our stockholders.“independent” used herein is based on the independence standards of The NASDAQ Stock Market LLC.

INFORMATION CONCERNING THE BOARD OF DIRECTORS AND ITS COMMITTEES

All directors are expected to make every effort to attend meetings of the Board of Directors, meetings of any Board Committees on which such director serves, and annual meetings of stockholders. The Board of Directors held eight14 meetings during the fiscal year ended September 30, 2016.2020. The Board of Directors also executed sixfour written consents to action in lieu of a meeting of the Board of Directors, which were approved unanimously. During the fiscal year ended September 30, 2016,2020, none of our currentthen directors attended fewer than 75 percent of the aggregate of (i) the total number of meetings of the Board of Directors held during the period for which he was a director, and (ii) the total number of meetings held by all committees of the Board on which he served during the periods that he served.served, except for Nourdean Anakar. All seven of our six directors attended the prior year’s annual meeting of stockholders. There is no family relationship between or among any of our directors and executive officers. We have fourfive directors who meet the definition of “independent director” under the NASDAQ Stock Market Rules, including Steven Jenkins, Nour-DeanNourdean Anakar, Luke Lirot, Yura Barabash, Elaine Martin and Robert L. Watters. Additionally, Yara Barabash, who is a nominee for election to the Board, meets the independence definition.Arthur Allan Priaulx.

| Page | 4 |

Eric Langan serves as both Chairman of the Board of Directors and Chief Executive Officer. Of our fourfive independent directors, no director has been designated “lead” independent director. Accordingly, all fourfive independent directors have an equal role in the leadership of the Board. We believe that our overall leadership structure is appropriate based on our current size.

As a part of its oversight function, the Board of Directors monitors how management operates the company. Risk is an important part of deliberations at the Board and committee level throughout the year. Committees consider risks associated with their particular areas of responsibility. The Board of Directors as a whole considers risks affecting us. To that end, the Board conducts periodic reviews of corporate risk management policies and procedures. The Board and its committees consider, among other things, the relevant risks to us when granting authority to management and approving business strategies. Through this risk oversight process, the Board reserves the right to make changes to our leadership structure in the future if it deems such changes are appropriate and in the best interest of our stockholders.

AUDIT COMMITTEE

We have an Audit Committee whose current members are Steven Jenkins, Nour-Dean Anakar, Luke LirotYura Barabash, Elaine Martin and Robert L. Watters.Arthur Allan Priaulx. All members of the Audit Committee are independent directors. The primary purpose of the Audit Committee is to (i) oversee our accounting and financial reporting process on behalfprocesses, our disclosure controls and procedures and system of internal controls and audits of our consolidated financial statements, (ii) oversee the Board of Directors.relationship with our independent auditors, including appointing or changing our auditors and ensuring their independence, and (iii) provide oversight regarding significant financial matters. The Audit Committee meets privately with our Chief Financial Officer and with our independent registered public accounting firm and evaluates the responses by the Chief Financial Officer both to the facts presented and to the judgments made by our outside independent registered public accounting firm. Steven L. JenkinsYura Barabash serves as the Audit Committee’s Financial Expert.financial expert. The Audit Committee held four16 meetings during the fiscal year ended September 30, 2016.2020.

In August 2015, our Board adopted a new Charter for the Audit Committee. A copy of the Audit Committee Charter can be found on our website atwww.rcihospitality.com/investor. The Charter establishes the independence of our Audit Committee and sets forth the scope of the Audit Committee’s duties. The purpose of the Audit Committee is to conduct continuing oversight of our financial affairs. The Audit Committee conducts an ongoing review of our financial reports and other financial information prior to their being filed with the SEC, or otherwise provided to the public. The Audit Committee also reviews our systems, methods and procedures of internal controls in the areas of: financial reporting, audits, treasury operations, corporate finance, managerial, financial and SEC accounting, compliance with law, and ethical conduct. NASDAQ Stock Market Rules require all members of the Audit Committee to be independent. The Audit Committee is objective, and reviews and assesses the work of our independent registered public accounting firm and our internal auditaccounting department.

Report of the Audit Committee

The Audit Committee has reviewed and discussed with management our audited financial statements for the fiscal year ended September 30, 2016.2020. The Audit Committee discussed with Whitley PennFriedman LLP (“Whitley Penn”Friedman”), our previous independent registered public accounting firm, who was engaged for the fiscal year ended September 30, 2016, the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee has received from Whitley PennFriedman the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Whitley Penn’sFriedman’s communications with the Audit Committee concerning independence, and has discussed with Whitley PennFriedman the independence of Whitley Penn.Friedman.

Based on the review and discussions referred to in the paragraph above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in our annual report on Form 10-K for the fiscal year ended September 30, 2016.2020. This report is furnished by the Audit Committee of our Board of Directors, whose members are:

Steven L. JenkinsYura Barabash

Luke LirotElaine Martin

Nour-Dean Anakar

Robert L. WattersArthur Allan Priaulx

NOMINATING COMMITTEE

We have a Nominating Committee whose current members are Steven Jenkins, Nour-Dean Anakar,Yura Barabash, Elaine Martin, Luke Lirot and Robert L. Watters.Arthur Allan Priaulx. In July 2004, the Board unanimously adopted a Charter with regard to the process to be used for identifying and evaluating nominees for director. The Charter establishes the independence of our Nominating Committee and sets forth the scope of the Nominating Committee’s duties. NASDAQ Stock Market Rules require all members of the Nominating Committee to be independent. Pursuant to its Charter, the Committee has the power and authority to consider Board nominees and proposals submitted by our stockholders and to establish any procedures, including procedures to facilitate stockholder communication with the Board of Directors, and to make any such disclosures required by applicable law in the course of exercising such authority. A copy of the Nominating Committee’s Charter can be found on our website atwww.rcihospitality.com/investor. The Nominating Committee held one meeting during the fiscal year ended September 30, 2016.2020.

| Page | 5 |

Stockholders who wish to submit a proposal for consideration by the Nominating Committee should review the proposal requirements and deadlines referenced in the section “Future Proposals of Stockholders” below. Stockholder recommendations to the Board of Directors should be sent to 10737 Cutten Road, Houston, Texas 77066, Attn: President.Attention: Corporate Secretary. Any stockholder recommendations for consideration by the Nominating Committee should include the candidate’s name, biographical information, information regarding any current or past relationships between the candidate and RCI Hospitality Holdings, Inc., a description of our shares beneficially owned by the recommending stockholder, a description of all arrangements between the candidate and the recommending stockholder and any other person under which the candidate is being recommended, a written indication of the candidate’s willingness to serve on the Board of Directors, any other information required to be provided under securities laws and regulations, and a written indication to provide such other information as the Nominating Committee may reasonably request. All candidates, whether proposed by a stockholder or by any other means, will be evaluated based on the criteria established by the Board of Directors. Minimum criteria for non-employee candidates includes financial experience and “independence” as defined under applicable rules promulgated by the SEC pursuant to the Sarbanes-Oxley Act of 2002 and NASDAQ Stock Market Rules. Additional criteria may include: (a) satisfactory results of any background investigation; (b) experience and expertise; (c) financial resources; (d) time availability; (e) community involvement; (f) diversity of viewpoints, backgrounds, experiences and other demographics, and (g) such other criteria as the Nominating Committee may determine to be relevant.

COMPENSATION COMMITEE

We have a Compensation Committee whose current members are Steven Jenkins, Nour-Dean Anakar,Yura Barabash, Elaine Martin, Luke Lirot and Robert L. Watters.Arthur Allan Priaulx. In June 2014, the Compensation Committee adopted a Charter with regard to the Compensation Committee’s responsibilities, including evaluating, reviewing and determining the compensation of our Chief Executive Officer and other executive officers. A copy of the Compensation Committee’s Charter can be found on our website atwww.rcihospitality.com/investor. The Compensation Committee held one meetingno meetings during the fiscal year ended September 30, 2016.2020.

Compensation Committee Report

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis (see below) to be included in this Proxy Statement on Schedule 14A. Based on this review and discussion, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this report. This report is furnished by the Compensation Committee of our Board of Directors, whose members are:

Steven L. JenkinsYura Barabash

Luke Lirot

Nour-Dean AnakarElaine Martin

Robert L. WattersArthur Allan Priaulx

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is comprised of Messrs. Jenkins,Yura Barabash, Elaine Martin, Luke Lirot Anakar and Watters.Arthur Allan Priaulx. No interlocking relationship exists between any member of the Compensation Committee and any member of any other company’s Board of Directors or compensation committee.

EXECUTIVE SESSIONS

At least twice a year the independent directors meet in executive session without company management present. One of the purposes of executive session meetings is to encourage and enhance communication among independent directors. Typically, executive sessions are held immediately after the year-end Audit Committee meeting and the second fiscal quarter-end Audit Committee meeting. Additional executive sessions may be held as needed. The independent directors held four executive sessions during the year ended September 30, 2016. The independent directors also executed one written consent to action in lieu of a meeting, which were approved unanimously.

Stockholder Communications

We do not currently have a formal process for security holders to send communications to the Board of Directors, which we believe is appropriate based on our size, the limited number of our stockholders and the limited number of communications which we receive. However, we welcome comments and questions from our stockholders. Stockholders can direct communications to our Chairman and Chief Executive Officer, Eric Langan at our executive offices, 10737 Cutten Road, Houston, Texas 77066. While we appreciate all comments from stockholders, we may not be able to individually respond to all communications. We attempt to address stockholder questions and concerns in our press releases and documents filed with the SEC so that all stockholders have access to information about us at the same time. Mr. Langan collects and evaluates all stockholder communications. If the communication is directed to the Board of Directors generally or to a specific director, Mr. Langan will disseminate the communication to the appropriate party at the next scheduled Board of Directors meeting. If the communication requires a more urgent response, Mr. Langan will promptly direct that communication to the appropriate executive officer or director. All communications addressed to our directors and executive officers will be reviewed by those parties unless the communication is clearly frivolous.

| Page | 6 |

COMPENSATION DISCUSSION AND ANALYSIS

This compensation discussion and analysis describes the material elements of the Company’s compensation programs as they relate to our executive officers who are listed in the compensation tables appearing below. This compensation discussion and analysis focuses on the information contained in the following tables and related footnotes. The individuals who served as the Company’s Chief Executive Officer and Chief Financial Officer during fiscal 2016,2020, as well as any other individuals included in the Summary Compensation Table, are referred to as “named executive officers.”

Overview of Compensation Committee Role and Responsibilities

The Compensation Committee of the Board of Directors oversees our compensation plans and policies, reviews and approves all decisions concerning the named executive officers’ compensation, which may further be approved by the Board, and administers our stock option and equity plans, including reviewing and approving stock option grants and equity awards under the plans. The Compensation Committee’s membership is determined by the Board and is composed entirely of independent directors.

Management plays a role in the compensation-setting process. The most significant aspects of management’s role are to evaluate employee performance and recommend salary levels and equity compensation awards. Our Chief Executive Officer often makes recommendations to the Compensation Committee and the Board concerning compensation for other executive officers. Our Chief Executive Officer is a member of the Board but does not participate in Board decisions regarding any aspect of his own compensation. The Compensation Committee can retain independent advisors or consultants.

Compensation Committee Process

The Compensation Committee reviews executive compensation in connection with the evaluation and approval of an employment agreement, an increase in responsibilities or other factors. With respect to equity compensation awarded to other employees, the Compensation Committee or the Board grants stock options, often after receiving a recommendation from our Chief Executive Officer. The Compensation Committee also evaluates proposals for incentive and performance equity awards, and other compensation.

Compensation Philosophy

The Compensation Committee emphasizes the important link between the Company’s performance, which ultimately affects stockholder value, and the compensation of its executives. Therefore, the primary goal of the Company’s executive compensation policy is to try to align the interests of the executive officers with the interests of the stockholders. In order to achieve this goal, the Company attempts to (i) offer compensation opportunities that attract and retain executives whose abilities and skills are critical to the long-term success of the Company and reward them for their efforts in ensuring the success of the Company, (ii) align the Company’s compensation programs with the Company’s long-term business strategies and objectives, and (iii) provide variable compensation opportunities that are directly linked to the Company’s performance and stockholder value, including an equity stake in the Company. Our named executive officers’ compensation utilizes two primary components — base salary and long-term equity compensation — to achieve these goals. We have not, however, granted any equity awards to our executive officers since 2014. Additionally, the Compensation Committee may award discretionary bonuses to certain executives based on the individual’s contribution to the achievement of the Company’s strategic objectives.

Setting Executive Compensation

We fix executive base compensation at a level we believe enables us to hire and retain individuals in a competitive environment and to reward satisfactory individual performance and a satisfactory level of contribution to our overall business goals. We also take into account the compensation that is paid by companies that we believe to be our competitors and by other companies with which we believe we generally compete for executives.

In establishing compensation packages for executive officers, numerous factors are considered, including the particular executive’s experience, expertise and performance, our company’s overall performance and compensation packages available in the marketplace for similar positions. In arriving at amounts for each component of compensation, our Compensation Committee strives to strike an appropriate balance between base compensation and incentive compensation. The Compensation Committee also endeavors to properly allocate between cash and non-cash compensation and between annual and long-term compensation.

The Role of Shareholder Say-on-Pay Votes

At our annual meeting of shareholders held on August 6, 2014,September 14, 2020, approximately 94.3%96.6% of the shareholders who voted on the “say-on-pay” proposal approved the compensation of our named executive officers, as disclosed in the proxy statement. Although this advisory shareholder vote on executive compensation is non-binding, the Compensation Committee will consider the outcome of the vote when making future compensation decisions for named executive officers.

| Page 7 |

Base Salary

The Company provides executive officers and other employees with base salary to compensate them for services rendered during the fiscal year. Subject to the provisions contained in employment agreements with executive officers concerning base salary amounts, base salaries of the executive officers are established based upon compensation data of comparable companies in our market, the executive’s job responsibilities, level of experience, individual performance and contribution to the business. We believe it is important for the Company to provide adequate fixed compensation to highly qualified executives in our competitive industry. In making base salary decisions, the Compensation Committee uses its discretion and judgment based upon personal knowledge of industry practice but does not apply any specific formula to determine the base salaries for the executive officers.

Equity-Based Awards—Equity Compensation Plans

The Compensation Committee uses equity awards, usually in the form of stock options, primarily to motivate our named executive officers to realize benefits from longer-term strategies that increase stockholder value, and to promote commitment and retention. Equity awards vest upon the achievement of performance criteria that the Company believes are critical to its long-term success.

The Compensation Committee believes that stock options are an important form of long-term incentive compensation because they align the executive officer’s interests with the interests of stockholders, since the options have value only if our stock price increases over time. From time to time, the Compensation Committee may consider circumstances that warrant the grant of full value awards such as restricted stock units. Examples of these circumstances include, among others, attracting a new executive to the team; recognizing a promotion to the executive team; retention; and rewarding outstanding long-term contributions.

Our equity grant practices require that stock options and other equity compensation have prices not less than the fair market value on the date of grant. The fair market value of our stock option awards has historically been the NASDAQ closing price on the date of grant.

Retirement Savings Plan

The Company maintains a retirement savings plan for the benefit of our executives and employees. Our Simple IRA Plan is intended to qualify as a defined contribution arrangement under the Internal Revenue Code (the “Code”). Participants may elect to defer a percentage of their eligible pretax earnings each year or contribute a fixed amount per pay period up to the maximum contribution permitted by the Code. All participants’ plan accounts are 100% vested at all times. All assets of our Simple IRA Plan are currently invested subject tobased on participant-directed elections, in a variety of mutual funds chosen from time to time by the Plan Administrator. Distribution of a participant’s vested interest generally occurs upon termination of employment, including by reason of retirement, death or disability.elections. We make certain matching contributions to the Simple IRA Plan.Plan, which are also 100% vested.

Perquisites and Other Personal Benefits

The Company’s executive officers participate in the Company’s other benefit plans on the same terms as other employees.employees on a non-discriminatory basis. These plans include medical, dental, life and disability insurance. Relocation benefits also are reimbursed and are individually negotiated when they occur. The Company reimburses each executive officer for all reasonable business and other expenses incurred by them in connection with the performance of their duties and obligations under their employment agreements.obligations. The Company does not provide named executive officers with any significant perquisites or other personal benefits except for personal travel using Company-owned automobiles and/or aircrafts, and housing and living expenses for our former CFO. In September 2019, the board of directors approved an automobileaircraft policy allowing personal use of Company aircrafts as follows: (1) 25 hours per fiscal quarter for our CEO, and (2) 12 hours each executive’s business use.per fiscal quarter for other executive officers.

Summary Compensation TableSUMMARY COMPENSATION TABLE

The following table reflects all forms of compensation for services to us for the fiscal years ended September 30, 2016, 20152020, 2019, and 20142018 of our named executive officers.

| Stock | Option | All Other | All Other | |||||||||||||||||||||||||||||||||||||||||

| Name and | Salary | Awards(1) | Awards | Compensation | Total | Salary | Bonus | Compensation(1) | Total | |||||||||||||||||||||||||||||||||||

| Principal Position | Year | ($) | ($) | ($) | ($) | ($) | Year | ($) | ($) | ($) | ($) | |||||||||||||||||||||||||||||||||

| Eric S. Langan | 2016 | 878,434 | - | - | 67,640 | (2) | 946,074 | 2020 | 1,073,077 | - | 95,975 | 1,169,052 | ||||||||||||||||||||||||||||||||

| President and Chief Executive Officer | 2015 | 832,143 | - | - | 67,505 | 899,648 | 2019 | 1,200,000 | - | 81,355 | 1,281,355 | |||||||||||||||||||||||||||||||||

| 2014 | 856,731 | 592,180 | - | 97,680 | 1,546,591 | 2018 | 1,015,384 | - | 119,904 | 1,135,288 | ||||||||||||||||||||||||||||||||||

| Phillip K. Marshall | 2016 | 255,866 | - | - | 26,038 | (2) | 281,904 | |||||||||||||||||||||||||||||||||||||

| Bradley Chhay(2) | 2020 | 269,231 | 25,000 | 50,333 | 344,564 | |||||||||||||||||||||||||||||||||||||||

| Chief Financial Officer | 2015 | 251,442 | - | - | 25,734 | 277,176 | ||||||||||||||||||||||||||||||||||||||

| 2014 | 246,538 | - | - | 29,070 | 275,608 | |||||||||||||||||||||||||||||||||||||||

| Travis Reese | 2016 | 299,945 | - | - | 36,119 | (2) | 336,064 | 2020 | 348,750 | - | 66,418 | 415,168 | ||||||||||||||||||||||||||||||||

| Executive Vice President | 2015 | 280,000 | - | - | 36,562 | 316,562 | 2019 | 390,000 | - | 76,622 | 466,622 | |||||||||||||||||||||||||||||||||

| 2014 | 241,538 | - | - | 18,447 | 259,985 | 2018 | 346,854 | - | 73,722 | 420,576 | ||||||||||||||||||||||||||||||||||

| Phillip K. Marshall(2) | 2020 | 290,625 | 25,000 | 58,837 | 374,462 | |||||||||||||||||||||||||||||||||||||||

| Former Chief Financial Officer | 2019 | 325,000 | - | 34,067 | 359,067 | |||||||||||||||||||||||||||||||||||||||

| 2018 | 294,231 | - | 32,580 | 326,811 | ||||||||||||||||||||||||||||||||||||||||

| (1) | |

| (2) |

| Name and Principal Position | Automobile Expenses ($) | Simple IRA Contribution ($) | Total ($) | |||||||||

| Eric S. Langan | 55,140 | 12,500 | 67,640 | |||||||||

| Phillip K. Marshall | 18,548 | 7,490 | 26,038 | |||||||||

| Travis Reese | 27,719 | 8,400 | 36,119 | |||||||||

| Page 8 |

A table of All Other Compensation for fiscal 2020 for our named executive officers is presented below:

| SIMPLE IRA Matching Contribution | Automobile Expenses | Personal Use of Aircraft | Housing and Living Expenses | Total All Other Compensation | ||||||||||||||||

| Name | ($) | ($) | ($) | ($) | ($) | |||||||||||||||

| Eric S. Langan | 16,880 | 33,006 | 46,089 | - | 95,975 | |||||||||||||||

| Bradley Chhay | 8,394 | 38,840 | 3,099 | - | 50,333 | |||||||||||||||

| Travis Reese | 6,750 | 59,668 | - | - | 66,418 | |||||||||||||||

| Phillip K. Marshall | 8,906 | 33,059 | - | 16,872 | 58,837 | |||||||||||||||

CEO Pay Ratio

We reviewed a comparison of annual total compensation of our CEO to the annual compensation of our median employee who was selected from all employees who were employed (other than the CEO) during our fiscal year ended September 30, 2020.

The SEC’s rules for identifying the median compensated employee and calculating the pay ratio based on that employee’s annual total compensation allow companies to adopt a variety of methodologies, to apply certain exclusions, and to make reasonable estimates and assumptions that reflect their employee populations and compensation practices. As a result, the pay ratio reported by other companies may not be comparable to the pay ratio reported below, as other companies have different employee populations and compensation practices and may utilize different methodologies, exclusions, estimates and assumptions in calculating their own pay ratios.

During the fiscal year ended September 30, 2020, the employment of the median employee that was identified in our Form 10-K for the fiscal year ended September 30, 2019 and 2018 was terminated. We recalculated and identified a new median employee using the same methodology as mentioned above.

The compensation for our CEO in fiscal 2020 of $1,169,052 was approximately 17 times the compensation of our fiscal 2020 median employee of $67,654.

GRANTS OF PLAN-BASED AWARDS

There were no grants of plan-based awards for the year ended September 30, 2016.fiscal 2020.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-ENDOutstanding Equity Awards at Fiscal Year-End

There were no outstanding equity awards as of September 30, 2016.2020.

OPTION EXERCISES AND STOCK VESTED IN FISCAL YEAR 20162019

The following table shows exercises ofThere were no stock options and vesting of restrictedexercised nor stock that vested during the fiscal 2016 for each of our named executive officer:year ended September 30, 2020.

| Option Awards | Stock Awards | |||||||||||||||

| Number of Shares Acquired on Exercise (#) | Value Realized on Exercise ($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($) | |||||||||||||

| Eric S. Langan | - | - | 58,000 | (1) | 583,480 | (2) | ||||||||||

| Phillip K. Marshall | - | - | - | - | ||||||||||||

| Travis Reese | - | - | - | - | ||||||||||||

DIRECTOR COMPENSATION

We pay the expenses of our directors in attending board meetings. We paid no equity-based compensation during the fiscal year ended September 30, 2016. We have agreed to pay2020, and we paid our non-executiveindependent directors $20,000$30,000 in cash for the 2015 and 2016 fiscal years.year. Following is a schedule of all compensation paid to our directors in the year ended September 30, 2016:

2020:

Fees earned or paid in cash | ||||

| Name | ($) | |||

| Luke C. Lirot | ||||

| Yura Barabash | 30,000 | |||

| Elaine Martin | 30,000 | |||

| Arthur Allan Priaulx | 30,000 | |||

| Eric S. Langan | - | |||

| Travis Reese | - | |||

| Page 9 |

EMPLOYMENT AGREEMENTS

On July 24, 2015,1, 2021, we entered into a new Employment Agreementtwo year employment agreements with each of our executive officers, including Eric Langan, our Chief Executive Officer and President, Eric Langan. His previous employment agreement expired on July 23, 2015. The new agreement has a term of three yearsPresident; Bradley Chhay, our Chief Financial Officer; and provides for an annual base salary of $875,000 for the first year of the term and an annual base salary of $900,000 for the second and third year of the term.

On September 15, 2014, we entered into a new Employment Agreement with Travis Reese, our Executive Vice President Directorand Secretary. Under their respective new agreements, Mr. Langan’s annual salary is $1,700,000; Mr. Chhay’s annual salary is $425,000; and Mr. Reese’s annual salary is $420,000. Each of Technology and Corporate Secretary. His previous employment agreement expired on July 23, 2014. The new agreementthe agreements has a term of three yearsthat commenced on July 1, 2021 and provides for an annual base salary of $280,000 for the first year, $300,000 for the second year and $320,000 for the third year.

On August 3, 2016, we entered into a new Employment Agreement with our Chief Financial Officer, Phillip K. Marshall. His previous employment agreement expired inends on June 2016. The new agreement has a term of two years, commencing on August 1, 2016. The new agreement provides for an annual base salary of $262,500 for the first year and $275,000 for the second year.

30, 2023. Each of the employment agreements of Messrs. Langan, Reese and Marshall also provides for bonus eligibility, expense reimbursement, health benefits, participation in allour benefit plans, maintained by us for salaried employees,use of a company-owned automobile, access to company-owned aircraft (subject to the terms and conditions of our corporate aircraft policy), and two weeks paid vacation. Also undervacation annually. Under the terms of the agreements, each agreement, the employeeexecutive is bound to a confidentiality provision and cannot compete with us for a period upon termination of the agreement. Further, in the event we terminate such employee without cause or such employee terminates his employment because we reduce or fail to pay his compensation or materially change his responsibilities, such employee is entitled to receive in one lump sum payment the full remaining amount under the term of his employment agreement to which he would have been entitled had his agreement not been terminated.

WeCurrently, our executive officers do not have not established long-term incentive plans or defined benefit or actuarial plans.plans outstanding.

EMPLOYEE STOCK OPTION PLANS

While we have been successful in attracting and retaining qualified personnel, we believe that our future success will depend in part on our continued ability to attract and retain qualified personnel. We pay wages and salaries that we believe are competitive. We also believe that equity ownership is an important factor in our ability to attract and retain skilled personnel. We have adopted stock option plans (the “Plans”) for employees and directors. The purpose of the Plans is to further the interests of the Company, our subsidiaries and our stockholders by providing incentives in the form of stock options to key employees and directors who contribute materially to our success and profitability. The grants recognize and reward outstanding individual performances and contributions and will give such persons a proprietary interest in us, thus enhancing their personal interest in our continued success and progress. The Plans also assist us and our subsidiaries in attracting and retaining key employees and directors. The Plans are administered by the Board of Directors. The Board of Directors has the exclusive power to select the participants in the Plans, to establish the terms of the options granted to each participant, provided that all options granted shall be granted at an exercise price not less than the fair market value of the common stock covered by the option on the grant date and to make all determinations necessary or advisable under the Plans.

In August 1999, we adopted the 1999 Stock Option Plan (the “1999 Plan”) with 500,000 shares authorized to be granted and sold under the 1999 Plan. In August 2004, stockholders approved an Amendment to the 1999 Plan (the “Amendment”) which increased the total number of shares authorized to 1 million. In July 2007, stockholders approved an Amendment to the 1999 Plan (the “Amendment”), which increased the total number of shares authorized to 1.5 million. The 1999 Plan was terminated by law in July 2009. Our Board of Directors approved theCompany’s 2010 Stock Option Plan, as amended, contractually expired on September 30, 2010. The 2010 Plan was approved by the stockholders of the Company for adoption at the 2011 Annual Meeting of Stockholders. At the 2012 Annual Meeting of Stockholders, stockholders approved amending the 2010 Plan to increase the maximum aggregate number of shares of common2020. There are presently no outstanding employee stock that may be optioned and sold from 500,000 to 800,000.

As of September 30, 2016, there are no stock options outstanding under any Plans.options.

COMPENSATION POLICIES AND PRACTICES AS THEY RELATE TO RISK MANAGEMENT

We attempt to make our compensation programs discretionary, balanced and focused on the long term. We believe goals and objectives of our compensation programs reflect a balanced mix of quantitative and qualitative performance measures to avoid excessive weight on a single performance measure. Our approach to compensation practices and policies applicable to employees and consultants is consistent with that followed for itsour executives. Based on these factors, we believe that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on us.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information at July 24, 2017,26, 2021, with respect to the beneficial ownership of shares of common stock by (i) each person known to us who owns beneficially more than 5% of the outstanding shares of common stock, (ii) each of our directors and nominees for the Board of Directors, (iii) each of our executive officers and (iv) all of our executive officers and directors as a group and (v) each of our nominees for election to the Board of Directors.group. Unless otherwise noted below, the address of each beneficial owner listed in the table is c/o RCI Hospitality Holdings, Inc., 10737 Cutten Road, Houston, Texas 77066. We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws. Applicable percentage ownership is based on 9,718,7118,999,910 shares of common stock outstanding at July 24, 2017.26, 2021. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of common stock subject to stock options or warrants held by that person that are currently exercisable or exercisable within 60 days of July 24, 201726, 2021 and shares of common stock issuable upon conversion of other securities held by that person that are currently convertible or convertible within 60 days of July 24, 2017.26, 2021. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. Beneficial ownership representing less than 1% is denoted with an asterisk (*).

| Page 10 |

| Number of | Percent of | |||||||||

| Name/Address | shares | Title of class | Class (1) | |||||||

| Executive Officers and Directors | ||||||||||

| Eric S. Langan | 708,000 | Common stock | 7.32 | % | ||||||

| Phillip K. Marshall | 13,810 | Common stock | * | |||||||

| Robert L. Watters | -0- | Common stock | * | |||||||

| Steven L. Jenkins | -0- | Common stock | * | |||||||

| Travis Reese | 11,805 | Common stock | * | |||||||

| Nourdean Anakar | -0- | Common stock | * | |||||||

| Luke Lirot | 518 | Common stock | * | |||||||

| All of our Directors and Officers as a Group of seven persons | 737,133 | Common stock | 7.58 | % | ||||||

| Director Nominee (Not Presently on Board of Directors) | ||||||||||

| Yura Barabash | -0- | Common stock | * | |||||||

| Other > 5% Security Holders | ||||||||||

| Dimensional Fund Advisors LP (2) | 853,590 | Common stock | 8.78 | % | ||||||

| Renaissance Technologies LLC (3) | 584,800 | Common stock | 6.02 | % | ||||||

| Name/Address | Number of shares | Title of class | Percent of Class (1) | |||||||

| Executive Officers and Directors | ||||||||||

| Eric S. Langan | 701,870 | (2) | Common stock | 7.80 | % | |||||

| Bradley Chhay | 4,020 | (3)(4) | Common stock | * | ||||||

| Yura Barabash | -0- | Common stock | * | |||||||

| Travis Reese | 14,141 | (5) | Common stock | * | ||||||

| Nourdean Anakar | -0- | Common stock | * | |||||||

| Luke Lirot | 518 | Common stock | * | |||||||

| Elaine Martin | 7,221 | Common stock | * | |||||||

| Arthur Allan Priaulx | 2,000 | Common stock | * | |||||||

| All of our Directors and Officers as a Group of eight persons | 726,030 | Common stock | 8.07 | % | ||||||

| Other > 5% Security Holders | ||||||||||

| BlackRock, Inc. (6) | 578,760 | Common stock | 6.43 | % | ||||||

| ADW Capital Partners, L.P.(7) | 899,900 | Common stock | 9.99 | % | ||||||

| Greenhaven Road Investment Management, L.P. (8) | 580,531 | Common stock | 6.45 | % | ||||||

| (1) | These percentages exclude treasury shares in the calculation of percentage of class. | |

| (2) | ||

| (3) | Number of shares is rounded to the nearest whole number. The actual amount is 4,020.317 shares. Through Mr. Chhay’s brokerage firm’s automatic dividend reinvestment program, on March 26, 2021 he received 0.163 shares, and on June 25, 2021 he received 0.154 shares. | |

| (4) | Includes 1,870 shares held in an investment club over which Mr. Chhay has shared voting and investment power. As of the date of this report, Mr. Chhay owns approximately 3.8% of the investment club | |

| (5) | Includes 1,870 shares held in an investment club over which Mr. Reese has shared voting and investment power. As of the date of this report, Mr. Reese owns approximately 1.6% of the investment club. | |

| (6) | Based on the most recently available Schedule 13G filed with the SEC on February |

| (7) | Based on the most recently available Schedule 13G filed with the SEC on January 8, 2021 by ADW Capital Partners, L.P., ADW Capital Management, LLC and Adam D. Wyden. ADW Capital Management, LLC is the general partner and investment manager of ADW Capital Partners, L.P. Mr. Wyden is the sole manager of ADW Capital Management, LLC. ADW Capital Partners, L.P is the record and direct beneficial owner of 899,900 shares, with sole voting power and sole dispositive power over all such shares. The address of each of these reporting persons is 1133 Broadway, Suite 719, New York, New York 10010. | |

| (8) | Based on the most recently available Schedule 13G filed with the SEC on February 16, 2021 by Scott Stewart Miller, Greenhaven Road Investment Management, LP (the “Investment Manager”), MVM Funds, LLC (the “General Partner”), Greenhaven Road Capital Fund 1, L.P. (“Fund 1”), and Greenhaven Road Capital Fund 2, L.P. (“Fund 2”, and together with Fund 1, the “Funds”). Each Fund is a private investment vehicle. The Funds directly beneficially own the common stock. The Investment Manager is the investment manager of the Funds. The General Partner is the general partner of the Funds and the Investment Manager. Mr. Miller is the controlling person of the General Partner. Mr. Miller, the Investment Manager and the General Partner may be deemed to beneficially own the common stock directly beneficially owned by the Funds, with sole voting power and sole dispositive power over all such shares. The address of each of these reporting persons is c/o Royce & Associates LLC, 8 Sound Shore Drive, Suite 190, Greenwich, CT 06830. |

The Company is not aware of any arrangements that could result in a change in control of the Company.

COMPLIANCE WITH SECTION 16(A) OF THE SECURITIES EXCHANGE ACT OF 1934Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own beneficially more than ten percent of our common stock, to file reports of ownership and changes of ownership with the Securities and Exchange Commission. Based solely upon a review of Forms 3, 4 and 5 furnished to us during the fiscal year ended September 30, 2016,2020, we believe that the directors, executive officers, and greater than ten percent beneficial owners have complied with all applicable filing requirements during the fiscal year ended September 30, 2016.2020, except for (i) two untimely Form 4s filed on March 19, 2020 and July 24, 2020 by Elaine Martin, our director, with respect to a total of seven transactions occurring on March 13, 16, and 19, 2020, and (ii) an untimely Form 4 filed on February 12, 2020 by each of Eric Langan, our Chief Executive Officer; Phillip Marshall, our former Chief Financial Officer; and Travis Reese, our Director and Executive Vice President, with respect to the same transaction involving an investment club.

| Page 11 |

PROPOSAL 2

TO RATIFY THE SELECTION OF BDO USA,FRIEDMAN LLP AS OUR INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 20172021